Effective Tactics to Dismiss Regulatory Concerns When Withdrawing Cryptocurrencies

The rapidly evolving world of cryptocurrency has ushered in a new era of regulatory uncertainty. As the industry continues to grow and mature, regulators around the world are struggling to balance innovation with risk. One area where concerns have emerged is cryptocurrency withdrawals. In this article, we will explore effective tactics to dismiss regulatory concerns in this sensitive area.

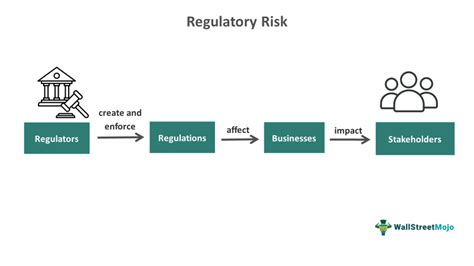

Understanding Regulatory Risks

Before diving into tactics to dismiss regulatory concerns, it is essential to understand the risks associated with withdrawing cryptocurrencies. Regulators have expressed concerns about the volatility and unpredictability of cryptocurrencies, as well as the potential for illicit activities such as money laundering and terrorist financing.

Some specific risks include:

- Unpredictable market conditions: Cryptocurrency prices can fluctuate rapidly and unpredictably, making it difficult to predict future trends.

- Lack of transparency: The decentralized nature of cryptocurrencies makes it difficult to track transactions and identify potential illegal activity.

- Risks associated with stablecoins: Stablecoin issuers must ensure that their systems are secure and resistant to hackers and other security threats.

Effective tactics to dismiss regulatory concerns

While regulatory concerns may arise when choosing cryptocurrencies, there are several effective tactics that can help mitigate these risks:

- Perform thorough risk assessments: Regularly review your business operations to identify potential weaknesses and assess the likelihood of regulatory issues.

- Implement robust security measures: Ensure all systems and processes are secure and up-to-date, including encryption, two-factor authentication, and multi-signature wallets.

- Implement a compliance program: Develop a comprehensive compliance program that includes training employees on regulatory requirements and best practices.

- Monitor market trends: Stay informed about changes in regulatory policies and guidelines so you can anticipate potential risks and adjust your strategy accordingly.

- Communicate with regulators: Establish open communication channels with regulators to ensure you are aware of any emerging issues or concerns.

Compliance Best Practices

Following compliance best practices is also essential to effectively dismiss regulatory concerns:

- Stay up to date on regulatory changes: Regularly review and update your business operations to ensure compliance with the latest regulations.

- Keep accurate records

: Keep detailed records of all transactions, including cryptocurrency withdrawals, to demonstrate compliance with regulatory requirements.

- Implement a risk-based approach: Focus on areas where risks are highest and take targeted steps to mitigate them.

Conclusion

Denying regulatory concerns in cryptocurrency withdrawals requires a multi-pronged approach that includes conducting thorough risk assessments, implementing robust security measures, establishing a compliance program, monitoring market trends, and communicating with regulators. By following best practices for compliance, businesses can effectively navigate the complex world of regulatory uncertainty and ensure long-term success.

Additional Resources

For more information on regulatory risks in cryptocurrency withdrawals and effective tactics to avoid them, please refer to the following resources:

- [Regulatory Reports]( from reputable organizations such as the Securities and Exchange Commission (SEC)

- [Industry Guides and Standards](