Understanding the Consequences of Non-Compliance in Crypto

The world of cryptocurrency has experienced rapid growth and adoption in recent years, but with this success comes a set of complex regulatory requirements that must be adhered to in order to avoid severe consequences. One critical aspect of compliance is understanding the potential consequences of non-compliance in the crypto space.

What Constitutes Non-Compliance?

Non-compliance refers to failing to meet or adhere to relevant regulations and laws, such as anti-money laundering (AML) and know-your-customer (KYC) requirements. These regulations are designed to prevent illicit activities, including money laundering, terrorism financing, and other serious crimes.

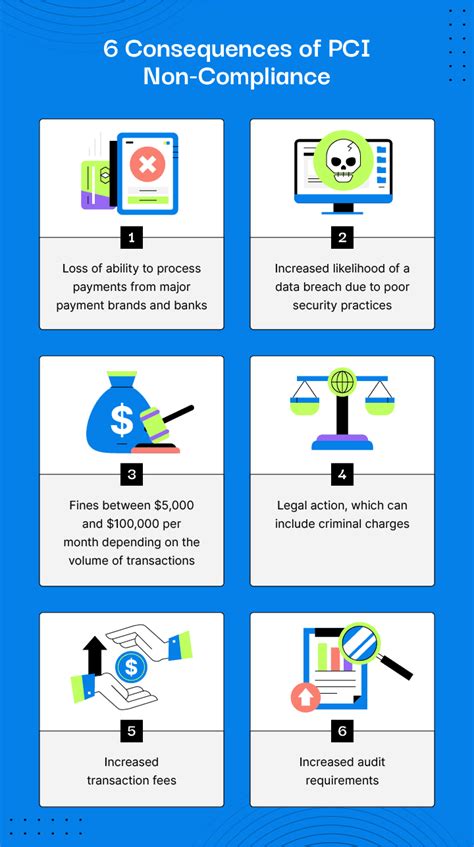

Consequences of Non-Compliance

Non-compliance can have severe consequences for individuals and businesses operating in the crypto space. Some potential outcomes include:

- Fines and penalties: Regulatory agencies, such as the US Securities and Exchange Commission (SEC), may impose significant fines on those found guilty of non-compliance.

- Loss of licenses: Businesses that fail to comply with AML/KYC regulations may lose their licenses or be forced to cease operations altogether.

- Reputational damage: Non-compliance can lead to a loss of reputation and trust among customers, investors, and other stakeholders.

- Regulatory actions: Regulatory agencies may take swift action against non-compliant businesses, including freezing assets or seizing property.

Cryptocurrency-Specific Risks

The crypto space is particularly vulnerable to non-compliance due to the unique characteristics of digital currencies. Some potential risks include:

- Unregulated exchanges: Unlicensed exchanges may pose a risk to users and investors by allowing illicit activities.

- Unverified wallets: Users may be vulnerable to phishing scams or other forms of exploitation if their wallets are not verified or secure.

Mitigating the Risks

To avoid non-compliance, it is essential to understand the regulatory requirements in place for the crypto space. This includes:

- Conducting thorough research: Before starting a business or investing in cryptocurrencies, it is crucial to conduct thorough research on regulatory requirements and risks.

- Obtaining necessary licenses: Businesses must obtain the necessary licenses and permits to operate within the regulations of their jurisdiction.

- Implementing robust security measures: Using secure wallets, verifying user identities, and implementing robust security protocols can help prevent non-compliance.

Conclusion

The consequences of non-compliance in crypto are severe and far-reaching. Understanding the regulatory requirements and risks associated with cryptocurrency can help businesses and individuals take steps to mitigate these risks and avoid non-compliance. By conducting thorough research, obtaining necessary licenses, and implementing robust security measures, we can ensure that our operations comply with relevant regulations and laws.