The Wild Ride of Cryptocurrencies: Understanding Market Orders, Volatility, and Reversal Patterns

The world of cryptocurrencies has been known for its volatility in recent years. The price of Bitcoin, for example, can fluctuate by as much as 10% in a single day, making it one of the most unpredictable assets on the market. But what drives this volatility? How do traders navigate these fluctuations? And what impact do these patterns have on investors and market participants?

Market Orders: The Basics

A market order is an instruction to buy or sell a specific asset at a specific price within a specific time frame. It’s like calling your broker and telling them to buy 100 Bitcoins at $5,000 per coin if the price hits $4,500 by tomorrow evening. Market orders are executed instantly and involve no risk, as you are essentially buying or selling with the intention of completing the trade before expiration.

Volatility: The Main Driver

Volatility in cryptocurrency markets is largely determined by market sentiment, liquidity, and technical analysis. When traders perceive a particular asset to be overbought or oversold, they are more likely to enter or exit the market, resulting in price fluctuations. Volatility can also be influenced by external factors such as government policies, economic indicators, and global events.

Reversal Patterns: The Early Warning Signs

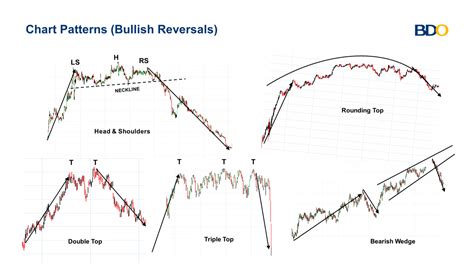

Reversal patterns are a type of technical indicator that signals an impending price change in cryptocurrency markets. These patterns look for certain combinations of chart features such as moving averages, trends, and swings to indicate a potential reversal or change in market direction.

Some common reversal patterns include:

- Head and Shoulders: This pattern consists of three peaks and a low where the asset price has reached a high followed by a downward trend.

- Inverted head and shoulders pattern: Similar to head and shoulders pattern but with two lows instead of one.

- Double top or double bottom: Two peaks or troughs each with two lower highs or lows.

Market orders and reversal patterns

When a reversal pattern is identified, market participants may respond by adjusting their trading strategy. For example:

- Long-term investors might adjust their buy orders to reflect the new market sentiment, such as increasing their position if they believe the asset is due for a price increase.

- Short-term traders might adjust their sell orders to capitalize on the expected price decline.

- Day traders might close their positions quickly to limit losses or lock in profits.

It is important to note, however, that market orders and reversal patterns are not foolproof predictors of future price movements. Market participants must also consider other factors such as liquidity, risk management, and fundamental analysis when making trading decisions.

Conclusion

Crypto markets are inherently volatile due to a combination of market sentiment, liquidity, and technical analysis. Understanding market orders, volatility, and reversal patterns is critical for traders, investors, and market participants alike. By recognizing these drivers and adjusting their strategies accordingly, we can better navigate the complex world of cryptocurrency trading.

Additional Resources

- Crypto Trading Strategies

: A comprehensive guide to crypto trading strategies, including market order types, risk management techniques, and reversal pattern analysis.

- Cryptocurrency Market Analysis: Detailed analysis of key market indicators, technical patterns, and fundamental factors that influence price movements in the cryptocurrency markets.

- Forex Trading Crypto: An overview of the overlap between crypto and traditional forex trading, including strategies for executing trades and managing risk.