Cryptocurrency Investing 101: Understanding Vesting Periods, Continuation Patterns, and Stop Losses

In the world of cryptocurrency trading, it is essential to have a solid understanding of the intricacies of investing in this space. Cryptocurrencies are known for their high volatility, making every trade a risky bet. However, by mastering key concepts such as vesting periods, continuation patterns, and stop loss strategies, investors can significantly reduce their risk and increase their potential returns.

Vesting Periods: A Crucial Concept

A vesting period is the length of time an investor or trader must hold their investment in a particular cryptocurrency before it becomes eligible for trading. The purpose of a vesting period is to ensure that the investor has sufficient exposure to the cryptocurrency for an extended period of time, allowing them to benefit from its price increases.

Here are some common examples of vesting periods:

- 20% vesting period: Investors must hold their investment for at least 80 days before they can sell or trade it.

- 50/50 vesting period: An equal portion of the investor’s exposure is released after a specified period of time, making it more difficult to predict price movements.

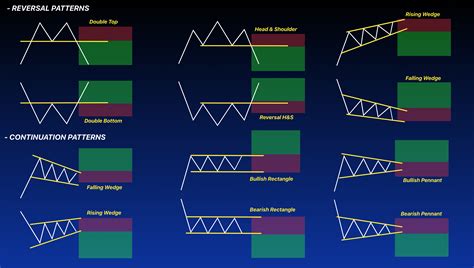

Continuation patterns: Identifying trends

Continuation patterns refer to specific buying and selling strategies used in the cryptocurrency markets. Understanding these patterns can help traders make informed decisions about their investments. Continuation patterns typically involve identifying a trend and then looking for buying or selling opportunities when the trend reverses or continues.

Some common continuation patterns include:

- Head and shoulders pattern: A reversal pattern that forms when the price of a cryptocurrency breaks above its previous high.

- Wedge and Triangle Patterns: Bearish and bullish reversal patterns, respectively, used to identify potential buying and selling opportunities.

Stop Loss Strategies: Risk Management

A stop loss is a vital part of any trading strategy. It is a predetermined price at which a trader sells their investment if it falls below a certain level, thereby limiting their potential losses. By implementing effective stop loss strategies, traders can:

- Limit Exposure

: Stop losses prevent significant losses in case the market moves against them.

- Protect Profits: By locking in gains before prices move significantly higher, traders can protect their profits.

Implementation Strategies: Putting It Into Practice

Once you understand the concepts of vesting periods, continuation patterns, and stop loss strategies, it’s time to put your knowledge into practice. Here are some tips:

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies and asset classes to minimize risk.

- Use Technical Analysis: Use charts and indicators to identify potential buying and selling opportunities.

- Stay Informed: Continuously monitor market developments, news, and sentiment to stay ahead of the curve.

In conclusion, mastering vesting periods, continuation patterns, and stop loss strategies is essential to successfully investing in cryptocurrencies. By understanding these concepts, traders can reduce their risk and increase their potential returns in this dynamic and unpredictable market. Remember that investing in cryptocurrencies carries a high degree of risk and it is essential to approach it with caution and a clear strategy.